Top 30 Forex Brokers Fundamentals Explained

Top 30 Forex Brokers Fundamentals Explained

Blog Article

Our Top 30 Forex Brokers Diaries

Table of ContentsThe Only Guide to Top 30 Forex BrokersTop 30 Forex Brokers Fundamentals ExplainedTop 30 Forex Brokers Fundamentals ExplainedTop 30 Forex Brokers Things To Know Before You Get ThisThe 9-Minute Rule for Top 30 Forex Brokers

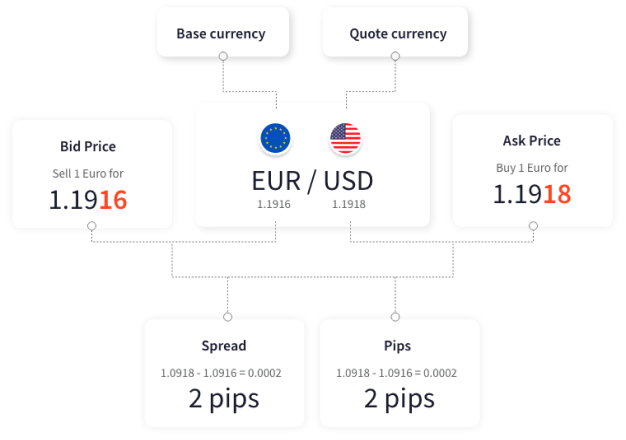

The wellness and performance of a particular money are connected closely to those of the releasing country or area. So indications of economic or political turmoil can cause a counter to drop. This is a specific risk for creating nation money. There are multiple approaches that traders can make use of to try and make an earnings on the forex market.Placement Trading The technique of selection for client capitalists who do not desire to regularly monitor the foreign exchange markets. This method sees people hold a placement for weeks, months, and possibly even years. They will take into consideration price patterns making use of essential evaluation and lasting charts. To prosper with forex trading, you need to comprehend the definition of some essential terms: A system of dimension that reveals the change in value in between 2 currencies The difference between the proposal rate and ask price.

The proposal rate is generally greater than the current cost The rate that a financier agrees to market a property for. The ask rate is generally less than the existing rate The actual cost of a possession on an exchange. The present cost on your foreign exchange trading system takes supply and need into account which is why you may see a difference The first currency listed in a foreign exchange set.

The smart Trick of Top 30 Forex Brokers That Nobody is Discussing

In the example over, the Euro is the quote currency The denomination that foreign exchange is traded in. One conventional lot has 100,000 devices of the base currency. A mini whole lot has 1,000 systems 7 typical pairs every one of which consist of USD as the base currency or counter money with one of the adhering to; GBP, EUR, JPY, NZD, AUD, CAD, CHF Likewise known as cross sets.

These can be very unstable A "loan" offered by a foreign exchange firm to a retail trader. A leverage of 1:30 means that a retail financier can open a setting 30 times the size of their preliminary stake Note, some of the phrases in this forex trading jargon buster are described in more detail somewhere else in this guide.

Top 30 Forex Brokers Things To Know Before You Buy

"OANDA", "fx, Trade" and OANDA's "fx" family members of trademarks are owned by OANDA Company. OANDA CORPORATION IS A PARTICIPANT OF NFA AND IS SUBJECT TO NFA'S REGULATORY OVERSIGHT AND EXAMS.

OANDA Company is not party to any type of purchases in digital properties and does not wardship digital properties in your place. All electronic possession transactions take place on the Paxos Count on Business exchange. Any type of positions in electronic possessions are custodied exclusively with Paxos and held in an account in your name beyond OANDA Corporation.

Even more Details is offered making use of the (XM)NFA Standard resource. (AVATRADE)

4 Simple Techniques For Top 30 Forex Brokers

It would stand to factor that, if you trade forex, you're trading on the "interbank" network. Unless you're trading upwards of a million currency devices per profession (at least), your purchases are most likely also small to be consisted of on an interbank feed. https://www.intensedebate.com/people/top30forexbs.

In order to buy (or offer) right into that market, you require to cross the bid/ask spread, so your indirect expense is 2 pips. If you're trading, claim, the value of the euro versus the U.S. dollar (EUR/USD), the monetary worth of one pip will certainly rely on at the very least two things: (1) Your residential currency (whether it becomes part of the money pair you're trading or otherwise) and (2) your setting dimension.

The rollover rate is the net rate of interest return on currency pairs you hold after 5 p - blackbull. m. ET. Keep in mind that when you get in a forex profession, you're borrowing one money to purchase another. If the rates of interest on your "long" visit currency is higher than that of your borrowed money, your account will be attributed based upon a positive web rate of interest return

The Buzz on Top 30 Forex Brokers

National federal governments intervene in the Foreign exchange Market to stabilise their very own currency or influence their economy. People and institutions trade money to benefit from rate motions. Not all money are equivalent in the Foreign exchange Market. Some currencies are more commonly used and traded than others. The most traded money are the major currency pairs, which include the most influential economies on the planet.

The spread, the space in between these rates, serves as a purchase cost. Spread is typically examined in PIPs, which represents "Percentage in Point" or "Cost Rate Of Interest Factor." A PIP signifies the tiniest cost change in a money set and represents a worth change of one unit in the final decimal point of the cost.

Report this page